You run a growing business and you spend mornings on invoices, afternoons on payroll, and late nights on forecasts. AI for financial planning can turn messy spreadsheets into precise forecasts, automated cash flow management, and more innovative scenario planning. Which tools cut manual work and give a forward-looking view of budgets, KPI dashboards, bookkeeping automation, and financial analytics? This article shows the best virtual CFO tools powering modern financial strategy.

Finsider’s QoE Reports brings precise forecasting, cash flow snapshots, and KPI dashboards together so you can make faster decisions, present clean performance reports, and keep strategic planning on track.

37 Best Virtual CFO Tools for Businesses

1. Finsider

Finsider targets virtual CFOs, advisory firms, and investors who need fast, accurate financial due diligence and financial analysis. The platform connects to accounting systems and runs a comprehensive 74-point financial scan that finds anomalies, adjustments, and trends with high precision. Its AI-driven Quality of Earnings engine can surface up to 95 percent of material issues while speeding report delivery by up to 60 percent compared with manual review.

For teams managing many engagements, it centralizes client data, enforces consistent reporting, and flags portfolio-level risks. It also offers a deal-based performance guarantee: if Finsider does not identify at least one material issue missed by your manual review, your first deal is free.

Key capabilities include:

- AI-assisted QoE reporting

- Direct accounting system integration

- Portfolio-level scalability

- Anomaly detection

- A guarantee

2. Cube

Cube focuses on financial planning, analysis, and reporting while integrating directly with ERPs, HRIS, and CRM systems. It allows finance teams to work within Excel and Google Sheets while centralizing data to enforce a single source of truth for budgeting and forecasting.

Cube supports scenario modeling, collaborative reporting, and real-time static reports so FP&A and virtual CFOs can iterate quickly. Core features include direct integrations, scenario and variance modeling, collaborative Excel and Sheets workflows, and centralized data management.

3. Zoho Books

Zoho Books is a cloud-based accounting platform that suits small companies as well as larger organizations requiring forecasting and inventory control. A free plan covers invoices, expenses, and banking reconciliation for digital-first businesses with tight budgets.

Paid plans add advanced inventory, forecasting, and expanded financial reporting as businesses grow.

4. PULSE

PULSE blends predictive AI and business analytics to improve forecasting, budgeting, and strategic planning for CEOs and CFOs. It integrates with existing systems to centralize data and produce unit economics and cash flow projections with higher accuracy.

Intuitive dashboards and visualizations enable proactive decisions and scenario testing.

5. Gusto

Gusto provides payroll and employee management for small and mid-sized businesses, with a free tier for basic payroll processing and paid tiers for expanded HR functionality. It automates payroll runs, tax calculations, and direct deposit while integrating with accounting systems to reduce reconciliation work. As teams scale, Gusto adds benefits administration, tax filings, and compliance support.

6. Wave

Wave offers free accounting tools that handle invoicing, payments, and cash flow tracking for small businesses and startups. Users receive an intuitive dashboard for viewing expenses and profits, with optional paid add-ons for payroll and tax filing. The platform keeps bookkeeping simple while providing real-time cash flow analysis and basic financial reporting.

7. Expensify

Expensify automates expense capture, receipt scanning, reimbursement, and report creation for individuals up to enterprise teams. A free plan suits solo users while paid tiers scale with corporate expense policies and approval workflows. Mobile apps support on-the-road capture and real-time reporting for transactions.

8. Xero

Xero supplies cloud accounting, invoicing, payroll, and expense management with a free trial to evaluate the platform. It fits growing businesses that need inventory, bank reconciliation, and real-time cash flow visibility. Xero’s ecosystem includes extensive app integrations for CRM, payroll, and ecommerce platforms.

9. DataRails

DataRails centralizes financial data from multiple sources to automate budgeting, forecasting, and reporting while preserving Excel workflows. It supports variance analysis and real-time dashboards, allowing finance teams to monitor KPIs without manual consolidation. The platform scales reporting across entities and integrates with corporate systems to keep actuals aligned with plans.

10. Causal

Causal makes financial modeling approachable with interactive dashboards and data integrations. Teams can build granular revenue models, track KPIs, and visualize scenarios without heavy formula maintenance. The product supports connection to accounting systems and offers intuitive charting for presentations to investors or management.

11. Fathom

Fathom specializes in financial analysis, custom management reports, and business performance tracking for SMBs and accountants. It offers automated cash flow forecasting with three-way projections covering P&L, balance sheet, and cash flow. Multi-entity consolidation and benchmarking help groups and franchises compare performance.

12. ApprovalMax

ApprovalMax layers multi-step approval workflows on top of Xero, QuickBooks, and NoteSuite to enforce pre-posting controls. You can create rules by amount, department, or requester and route bills or purchase orders to the correct approvers with a complete audit trail. Once approved, data syncs into the accounting system without manual entry, reducing unauthorized spend and email friction.

13. Workday Adaptive Planning

Workday Adaptive Planning replaces spreadsheet chaos with collaborative budgeting, forecasting, and scenario modeling for companies that need to scale FP&A. It integrates with ERPs and other data sources to keep models current and lets users run what-if scenarios across departments. Dashboards and role-based reports present tailored views without breaking the core model.

14. Finmark

Finmark builds real-time forecasts by connecting accounting, payroll, and CRM systems for startups and small businesses. It models cash flow, hiring plans, and revenue scenarios so founders and CFOs understand runway and burn. The product updates forecasts as actuals arrive and supports different business models, including SaaS and services.

15. Sovos

Sovos automates indirect tax compliance for sales tax, VAT, and GST across jurisdictions and integrates with ERP and ecommerce systems. It determines tax liability, calculates amounts, and handles filings and remittance while tracking regulatory changes in more than 70 countries. The system reduces audit risk and supports multinational tax requirements.

16. TaxJar

TaxJar automates sales tax calculation, reporting, and filing for sellers on platforms like Shopify, Amazon, and Stripe. It tracks nexus thresholds, collects tax by location at checkout, and can file returns automatically across states. Dashboards show tax collected per state and upcoming liabilities to help with treasury management.

17. Deel

Deel lets companies hire and pay employees and contractors in more than 150 countries without setting up local entities. It handles contract templates, local compliance, payroll in local currency, and benefits administration. HR and finance teams get centralized dashboards for onboarding, recurring payments, and tax documentation.

18. NetSuite Fixed Assets

NetSuite Fixed Assets manages purchases, depreciation, revaluation, and disposal while syncing with the general ledger. You can schedule depreciation methods and automate postings so asset ledgers stay current with financial reporting. Built-in reports and audit logs support tax and GAAP compliance for fixed asset management.

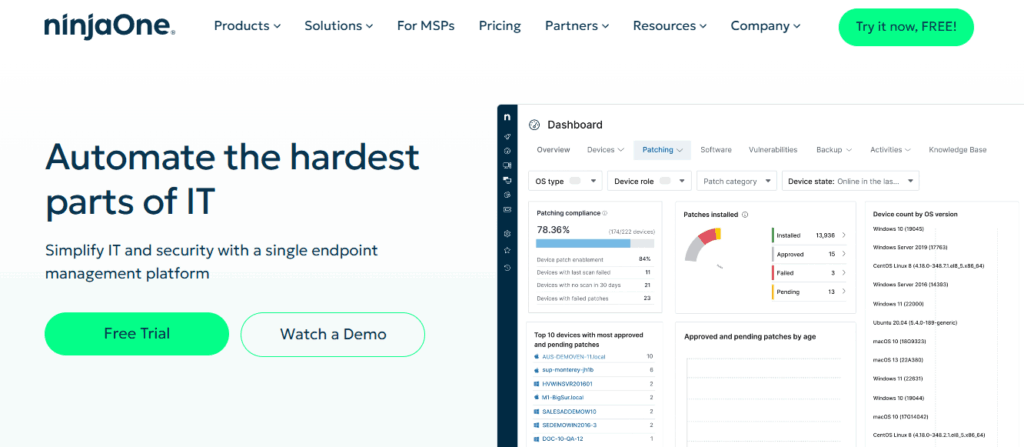

19. NinjaOne

NinjaOne is an RMM platform that tracks hardware and software inventory, automates patching, and offers remote access for IT teams. It simplifies device monitoring, script pushing, backup, endpoint protection, and ticketing to reduce downtime and administrative overhead. For finance and operations, accurate IT asset data helps control software spend and support audits.

20. Sage Intacct

Sage Intacct delivers cloud-based core accounting capabilities such as accounts payable, receivable, general ledger, and advanced budgeting with real-time dashboards. It supports multi-entity consolidation and pre-built analytics for CFOs who need consolidated financial reporting.

Integrations extend functionality for billing, inventory, and CRM workflows. Features include automated transactions, multi-entity consolidation, budgeting and financial reporting, and analytics dashboards.

21. AccountMate

AccountMate provides ERP and accounting with on-premises and cloud options ideal for small to mid-sized businesses that need cost-effective controls. The interface focuses on usability and streamlined data entry while offering detailed reporting and customizable workflows. Optional inventory modules and permission controls support business-specific processes.

22. Acumatica Cloud ERP

Acumatica Cloud ERP offers CRM, sales, and financial features with multi-currency support and real-time reporting. The platform supports automated billing, collaboration across teams, and integrations to tools like DocuSign and Power BI. It scales for international businesses and provides customizable workflows for operations and finance.

23. Zoho Expense

Zoho Expense automates expense report creation, travel booking, and policy enforcement for businesses of all sizes. It supports corporate card management, multi-level approvals, mileage tracking, and SmartScan receipt capture to speed reconciliations.

Real-time analytics and compliance tools help finance teams control spend and enforce rules.

24. Microsoft Planner

Microsoft Planner offers Kanban-style task boards, multiple project views, and deep integration with Teams and SharePoint for project and task management. It helps teams track progress, attach files, and collaborate in context with their Microsoft 365 workflows. Premium capabilities can include AI-assisted planning through Copilot to support resource and schedule planning.

25. Asana

Asana provides task and project management, portfolio tracking, and integrations with over 200 tools to coordinate work across teams. It supports Lists, Boards, Timelines, and Calendars, plus custom workflows and templates to automate recurring processes. Built-in AI functionality assists with workflow automation, insights, and task suggestions for better execution.

26. Workiva

Workiva unifies financial, ESG, audit, and risk reporting with data linking and real-time collaboration for enterprise reporting needs. It supports SOX and other compliance programs while connecting multiple data sources and providing versioned audit trails. Automation and workflow management speed report assembly for SEC filings and compliance deliverables.

27. MetricStream

MetricStream centralizes risk, compliance, and audit management with real-time analytics, workflow automation, and strong security controls. It addresses policy management, vendor risk, cybersecurity posture, and audit planning for organizations that must track regulatory obligations. The platform integrates with core systems to provide consistent controls and reporting for risk teams.

28. ADP Workforce Now

ADP Workforce Now combines payroll, HR, benefits, time and attendance, and talent management in a single HCM solution designed for mid-sized and larger businesses. It automates payroll processing, tracks compliance, and provides reporting and analytics for workforce planning. The suite supports benefits administration and integrated time tracking for operational efficiency.

29. Vena

Vena integrates deeply with Microsoft 365 products to provide budgeting, forecasting, consolidation, and reporting while preserving Excel as the user interface. A centralized database offers CFOs a single source of truth, while two AI tools, Vena Copilot and Vena Insights, enhance productivity and decision-making. The solution supports financial consolidation, scenario planning, and data governance across teams.

30. Anaplan

Anaplan offers enterprise-scale FP&A, sales and revenue planning, and workforce modeling using a scalable in-memory engine called Hyperblock. It connects data across the organization to enable real-time scenario planning and performance tracking. Finance teams use it for complex planning where linked operational and financial models must remain synchronized.

31. Planful

Planful automates planning, budgeting, and forecasting with a low-code drag-and-drop interface that makes financial and operational data available in real time. The system’s AI-powered Predict tool finds patterns to automate forecasts and reduce manual errors. It supports consolidation, reporting, and scenario testing for finance teams that want faster close cycles.

32. Jirav

Jirav helps small and medium businesses and accounting firms forecast, budget, and build dashboards with automated reporting. It offers scenario planning, cash flow monitoring, and KPI dashboards that keep CFOs and advisors informed of working capital assumptions. The platform supports custom planning models for client engagements and quick scenario creation for strategic shifts.

33. Pigment

Pigment enables finance, HR, and revenue teams to build integrated plans and forecasts in a single system that supports collaboration and access controls. It provides drill-down and waterfall charts, plus automated workflows to accelerate approvals and model updates. Finance teams can build multidimensional models that draw data from multiple sources for agile planning and forecasting.

34. Mosaic Tech

Mosaic connects HRIS, CRM, ERP, and data warehouses to provide real-time analytics, three statement models, and what-if scenario planning for finance teams. It includes model builders for customized forecasts and a chat-based AI assistant to surface insights and automate tasks. Mosaic helps FP&A teams monitor workflows and generate actionable metrics for decision making.

35. NetSuite Planning and Budgeting

NetSuite Planning and Budgeting centralizes financial and operational planning into a collaborative solution that automates labor-intensive processes. Finance teams can produce budgets and forecasts, run what-if scenarios, and use pre-built reports and templates to accelerate planning. A premium edition includes industry-specific modules for nonprofits, software, agencies, and services with consultant-led implementation options.

36. Oracle PBCS

Oracle Planning and Budgeting Cloud Service provides operational planners with flexibility through built-in best practices and high configurability for strategic modeling, as well as workforce and capital planning.

The service provides business process frameworks for financials, projects, and workforce that can be used out of the box or tailored for unique requirements. For finance teams, it supports strategic modeling, scenario testing, and controlled planning workflows.

37. OneStream

OneStream unifies planning, reporting, consolidation, and analytics while enabling finance teams to build embedded AI models on top of their data models. Its generative AI lets users query and interact with financial intelligence using natural language and workflow automation. The extended planning and analysis capability helps align operational plans with financial performance across the enterprise.

Related Reading

Key Features to Look for in Virtual CFO Software

The strongest virtual CFO tools link directly to core systems like:

- QuickBooks

- Xero

- NetSuite

- Bank feeds

- Payroll providers

- Payment gateways

- CRM platforms

Look for API based connectors, webhooks, and reliable ETL that map the chart of accounts and normalize vendor and customer records. Multi-entity consolidation, intercompany elimination, and support for multiple currencies matter if you run or advise groups of companies. Which systems must sync for you to stop chasing spreadsheets?

Automation: Replace Repetitive Work With Consistent Processes

Search for automated bank reconciliation, expense capture with OCR, recurring journal entries, billing workflows, and rules-driven transaction classification. Automation reduces manual entry, lowers error rates, and accelerates the financial close.

Workflow approvals and audit logs keep changes visible and auditable while machine learning improves categorization over time. What routine tasks could you hand off to software today?

Forecasting and Scenario Modeling: Test Outcomes Before You Commit

Choose tools that produce linked profit and loss statements, balance sheets, and cash flow forecasts from the same set of assumptions.

- Driver-based forecasting

- Rolling forecasts

- Sensitivity analysis

- Scenario comparisons let you model hiring plans

- Fundraising rounds

- Sales swings and the impact on cash runway, margin, and covenants

Version control and an assumptions library make comparisons clean and repeatable for FP&A and deal work. Which scenarios would change your next strategic move?

Collaboration: Keep Teams and Clients Aligned With Secure Access

Good virtual CFO platforms offer multi-user dashboards, client portals, role-based permissions, in-line comments, and task assignment, enabling accountants, founders, and advisors to work from the exact numbers. Integrations with Slack or Teams and scheduled report delivery eliminate status update meetings and messy email threads.

White labeling and client-level views help firms scale advisory services while maintaining control and oversight. Who on your team needs which level of access?

Visual and Customizable Reporting Dashboards: Turn Metrics into Decisions

Look for dashboards that visualize KPIs, variances, and trend lines with drill-downs to source transactions. Custom widgets, KPI libraries, benchmarking tools, and ad hoc report builders let you tailor views by client, product line, or department.

Export options, scheduled reporting, and one-click board packs save time when you must present results to investors or management. What key indicator do you want to see first when a report loads?

Security and Compliance: Protect Data and Pass Audits

Prioritize platforms with enterprise-grade encryption, multi-factor authentication, strong role-based access, continuous audit logging, and data residency controls. Compliance with SOC 2, GDPR, and industry standards supports due diligence, while regular penetration testing and vendor risk assessments reduce exposure.

Built-in segregation of duties and immutable audit trails make it easier to support external audits and regulatory reviews. Which standards will satisfy your clients and auditors?

Finsider AI: Faster, Smarter Financial Scans

Ready to deliver QoE reports 60% faster while identifying issues that manual reviews miss? Finsider’s AI-powered financial analysis platform connects to your client’s accounting systems. It performs a comprehensive 74-point scan in minutes, catching 95% of material issues compared to just 65% with traditional methods, freeing your team to serve more clients with lower costs and reduced risk.

Book a demo today and experience our deal-based guarantee: if our AI does not identify at least one material issue your manual review missed, your first deal is completely free.

Related Reading

How Virtual CFO Tools Improve Financial Leadership

Virtual CFO tools put cash flow, bank activity, and profitability on a single live dashboard. When numbers update continuously, leaders spot drops in working capital or sudden expense spikes as they happen, not weeks later. American Express found that in 2024, 75% of CFOs said digital transformation was gaining momentum and becoming more strategically important, which explains why finance teams push for real-time analytics and financial dashboards.

Xero research shows 60% of small business owners face cash flow problems, and 14% never recover. Therefore, continuous cash flow management and alerting change how a CFO prioritizes action. How quickly could you change direction when your forecasts update every day?

Streamline Reporting and Stay Audit Ready

Automated reporting and reconciliation cut manual hours and shrink error rates. Virtual CFO platforms pull data from:

- Accounting

- Payroll

- Banking

- ERP systems

- Produce standardized management reports

- Generate audit trails that make compliance work repeatable

That frees finance leaders to interpret variance, refine strategy, and advise the business instead of wrestling with spreadsheets. What recurring report would you eliminate if you could trust the system to produce it accurately?

Scenario Modeling and Stress Tests You Can Run Instantly

Forecasting and scenario modeling let leaders test rate changes, sales shocks, or hiring plans before they roll out. Modern CFO software offers rolling forecasts, sensitivity analysis, and what-if scenarios, allowing you to see the cash and margin consequences of decisions in hours rather than days.

Use these tools to plan for a downturn, evaluate capital raises, or size a new market entry. Which risky assumption would you model this week?

Scale Financial Leadership Across Clients and Divisions

For outsourced and fractional CFOs, a single virtual CFO platform scales oversight across multiple clients without a proportional increase in effort. Unified data integrations, role-based access, batch reporting, and financial consolidation enable a single leader to deliver consistent FP&A automation and advisory across many accounts.

This drives repeatable workflows, faster onboarding, and more predictable margins for advisory services. How many more clients could you add if your reporting and consolidation were automated?

Operational Risk Control and Better Governance

Virtual CFO tools bring controls into the daily flow of work. Automated reconciliations, approval workflows, and permissioned access reduce fraud and control gaps while preserving auditability.

They combine compliance automation with real-time reporting so governance moves from box checking to active management. Which control gap would you tighten first with system-enforced approvals?

Data Integration and Cleaner Financial Intelligence

A reliable virtual CFO platform centralizes ledger entries, subledgers, bank feeds, and third-party data into a single source of truth. Clean data improves forecasting accuracy, speeds month-end, and supports advanced analytics like driver-based planning and KPI cohorts.

When data is consistent, CFOs spend more time on insights and less time on data rescue. What data feed would unlock the most accurate forecast for you?

Decision Velocity and Confident Advising

With automated dashboards, scenario outputs, and audit-ready reports, CFOs make decisions faster and present recommendations with evidence rather than intuition. That changes the role of finance from scorekeeper to trusted growth partner who can recommend capital allocation, pricing moves, or operational trade-offs with supporting models at hand. Who in your leadership team would benefit most from seeing these models in real time?

4 Tips for Choosing the Right Virtual CFO Tools

1. Right-Sized Features for Your Company Size and Complexity

Assess what your business actually does and how your finance function operates. Count legal entities, revenue streams, number of transactions per month, currencies, and regulatory requirements.

For a small company, prioritize:

- Cash flow management

- Bank feeds

- Basic accounting integration

- KPI dashboards

- Invoicing

- Simple forecasting

A growing or mid-market firm requires consolidation, rolling forecasts, scenario planning, intercompany eliminations, fixed asset tracking, and multi-currency support.

Look at Architecture and Scaling Options

Prefer modular platforms with APIs that integrate with your ERP, payroll, CRM, and payment processors, allowing you to add FP&A, treasury, or consolidation features only when needed. Check security controls, audit trail, and role-based access to support multiple users and external accountants without exposing sensitive data.

Ask this:

How many users, entities, and currencies must the tool handle today and in three years?

2. Make Adoption Fast and Smooth

Choose a platform that your finance team and non-finance stakeholders will actually use. Prioritize an intuitive interface, clear report templates, visual dashboards, and a flexible report writer that requires little technical work. Look for guided onboarding, in-product help, training courses, and a sandbox environment where teams can practice without risking live data.

Evaluate collaboration features such as shared notes on reports, task assignments during the close, version history, and easy export to spreadsheets. Consider mobile access and APIs for automated data flows to move routine tasks off manual spreadsheets and into automation. Ask who will own the administration and how much training time you can commit

3. Cost, ROI, and Support That Keep You Running

Map subscription fees to real costs. Compare pricing per user, per entity, and per feature, and add expected costs for implementation, data migration, custom reports, and recurring integrations.

Factor in ongoing expenses for professional services and any transaction fees. Calculate ROI from faster close times, fewer reconciliations, improved cash forecasting, and reduced advisory hours.

Vet Vendor Support and Service Levels

Confirm response times, availability of a dedicated customer success manager, professional services for complex setups, and a published product roadmap. Check security certifications such as:

- SOC reports

- Data encryption

- Two-factor authentication

- Backup policies

Negotiate trial pricing, pilot scopes, and termination terms so you avoid surprise charges and lock in predictable costs.

What level of support and cost structure matches your budget and growth plan?

4. Test Drive With Real Scenarios Before You Commit

Run live demos and hands-on trials using your own data and processes. Build a test script that covers month-end close, cash flow projection, a forecast scenario, a consolidation exercise if applicable, and the typical reports you send to stakeholders. Validate bank feed reconciliations, API integrations with payroll and billing, export and import routines, and the accuracy of automated journal entries.

Request reference calls and case studies from companies of similar size and industry, and ask about time to value, integration pitfalls, and who handled implementation. Use a scoring matrix to compare usability, reporting, automation, security, and total cost of ownership, ensuring that decision-making remains objective. Can the vendor reproduce your critical workflows in a trial environment and show measurable improvements in time or accuracy?

Deliver QoE Reports 60% Faster with Finsider

Finsider produces quality earnings reports up to 60% faster while surfacing issues that manual reviews often miss. The platform links to client accounting systems, runs a 74-point scan in minutes, and flags items that need human review.

It reports that its scan finds 95% of material issues compared to about 65% for traditional approaches. Want to see the difference in a recent deal?

How Finsider Connects to Your Accounting Systems and Tools

You connect Finsider to the client accounting ledger, bank feeds, AR and AP modules, and ERP connectors used by QuickBooks, Xero, and other systems. The platform ingests invoices, payroll entries, billing data, and the general ledger, then normalizes transactions for consistent analysis across multiple clients. Which systems do you use most, and how would a direct connector change workflow?

The 74 Point Scan Explained in Plain Terms

The scan runs automated checks across revenue recognition, cost allocation, one-time items, intercompany activity, related party transactions, customer credits, chargebacks, manual journal entries, and unusual patterns in billing and collections.

It performs variance analysis, cash flow checks, and account reconciliation signals to prioritize risk. The goal is to reduce blind spots that slip through manual sampling and to surface anomalies for quick review.

Why Detection Improves From 65% To 95%

Automation lets the system evaluate every transaction instead of a sample. Pattern detection and financial modeling combine to highlight outliers in revenue streams, timing gaps, and classification errors.

Machine learning refines its signals using historical deal outcomes, so the model learns what constitutes material. How much more confidence would your team have with that level of coverage?

Qoe Reporting 60% Faster and Where the Time Savings Come From

Finsider automates data ingestion, automated reconciliations, KPI calculations, and draft narrative generation for deal workbooks. That removes repetitive tasks like manual mapping, spreadsheet rework, and basic checklist items.

Analysts spend less time on data gathering and more time on interpretation and client advisory. Could your team handle more deals without adding headcount?

How This Fits Into Virtual CFO Tools and Advisory Services

Finsider plugs into cash flow forecasting, budgeting, scenario planning, KPI dashboards, and performance metric reporting used by Virtual CFO tools. It complements cash flow modeling and treasury management workflows while improving P&L analysis, balance sheet review, and variance analysis. The platform supports automated reporting, benchmark comparisons, and client portals that advisors use to deliver board-ready packs and monthly advisory packages.

Cost, Risk, and Scaling Your Practice

By cutting review time and catching more material issues, Finsider reduces remediation costs, lowers deal risk, and helps firms scale advisory work. Firms can expand client capacity without a linear increase in labor cost.

That reduces pressure on billing rates while improving quality controls and compliance with audit trail requirements. Which clients would you prioritize for faster QoE delivery?

Security, Compliance, and Audit Readiness

Finsider maintains encrypted data connections, role-based access, and an immutable audit trail of scans and reviewer decisions. The system records source documents, change logs, and flagged items for regulator review or buyer due diligence. It integrates with accounting controls and supports evidence packs for external audits and internal compliance checks.

Implementation, Workflow, and Team Adoption

Implementation focuses on connector setup, mapping, and a pilot deal with side-by-side comparison to your current review. The platform produces prioritized findings, suggested adjustments, and exportable schedules that feed into your existing templates.

Training centers on using the AI signals to guide judgment rather than replace it. How would you map a pilot into your current deal pipeline?

Deal-Based Guarantee and Demo Invitation

Book a demo to view a live scan of sample data and test the deal-based guarantee. If Finsider does not identify at least one material issue that your manual review missed, your first deal is free.

The guarantee places the burden on measurable performance, providing your team with a low-risk way to validate detection rates and speed gains. When can we schedule a hands-on session?